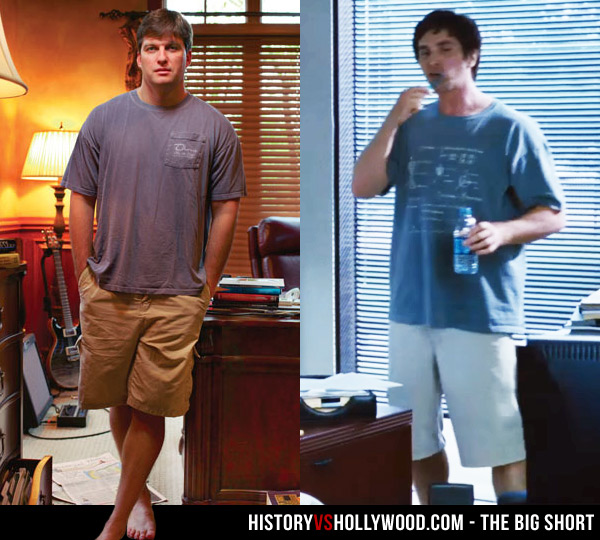

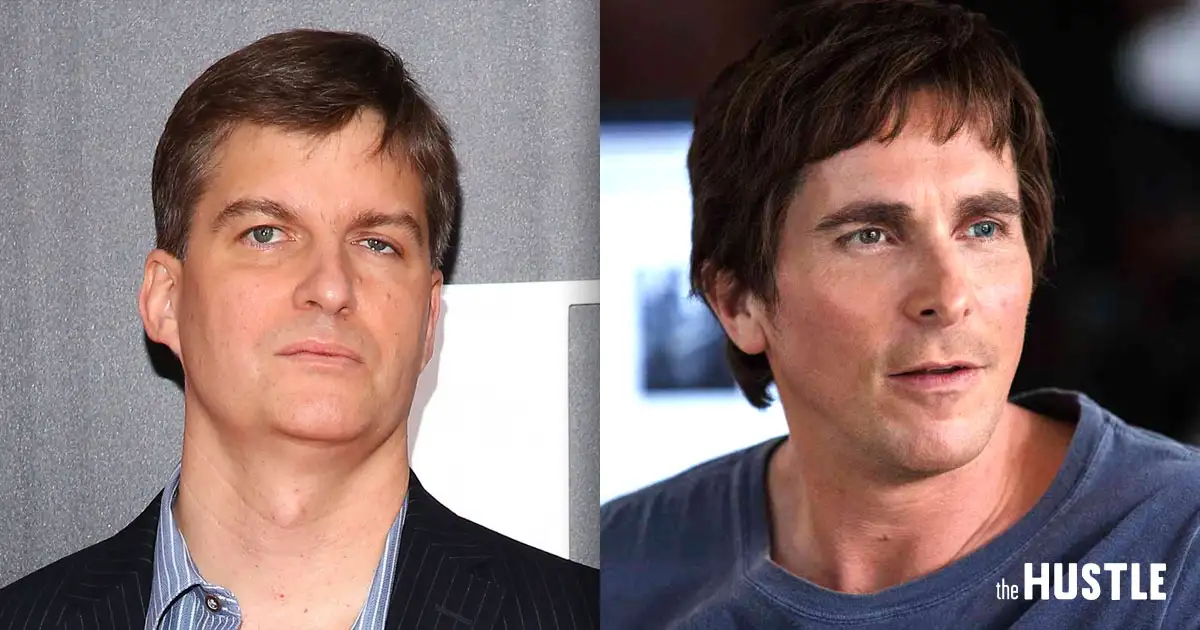

The Big Short guys made a significant amount of money from their successful investments. The Big Short, a 2015 film directed by Adam McKay, is based on the true story of a group of investors who predicted and profited from the 2008 financial crisis.

These investors, including Michael Burry, Steve Eisman, and Mark Baum, recognized the impending collapse of the housing market and bet against mortgage-backed securities. Their risky but astute decisions resulted in substantial profits for them and their clients, earning millions and even billions of dollars.

The film highlights the complexities and ethical dilemmas involved in betting against the housing market and exposes the flaws in the financial system that contributed to the crisis. Overall, The Big Short showcases the lucrative gains made by these investors through their keen insight and ability to capitalize on market momentum.

Credit: thehustle.co

Their Bold Bet On The Housing Market Crash

The big short guys made a significant amount of money on their bold bet against the housing market crash. Their actions involved a high-risk strategy that required thorough research and analysis. They understood the pivotal moment to be when they decided to go all-in.

These guys delved deep into the market’s intricacies, carefully evaluating the risks and opportunities. Their boldness paid off, as they accurately predicted the crash and capitalized on it. This success was the result of their extensive research, which helped them identify the warning signs and determine the best course of action.

Their well-planned strategy and willingness to take risks allowed them to make substantial profits from the market’s downturn. The big short guys’ story serves as a testament to the potential rewards that can come from astute analysis and strategic investment decisions.

Massive Profits Amidst The Chaos

The Big Short guys generated massive profits amidst the chaos of the market collapse. Quantifying their astounding financial gains, it becomes clear just how successful they were. Comparing their returns to traditional investments, one can truly appreciate the magnitude of their achievements.

Afterward, they celebrated their victories in various ways, reveling in the remarkable success they achieved.

Lessons To Learn From The Big Short Guys

The Big Short guys made significant profits by understanding the risks and rewards of short selling. Thorough research and analysis played a crucial role in their success. They were able to identify the signs of a looming market crash and applied their strategies to everyday investing.

By carefully evaluating market trends, they were able to mitigate their risks and maximize their profits. Their approach serves as a valuable lesson for investors, emphasizing the importance of being proactive and staying ahead of market fluctuations. The Big Short guys demonstrated the power of knowledge and strategy in the face of a volatile market.

As investors, we can learn from their experiences and apply their insights to make informed decisions that optimize our returns.

The Impact Of The Big Short Guys’ Success

Unveiling the flaws in the system, they exposed the weaknesses of Wall Street. Their success had a profound impact on financial markets, shaking up the status quo. The big short guys not only made significant profits but also left a long-lasting mark on the housing market.

Their actions uncovered the vulnerabilities in the mortgage industry, leading to a ripple effect that changed the way Wall Street operated. However, their achievements did not come without challenges and criticisms. Many questioned their motives and techniques, labeling them as opportunistic and unethical.

Despite the controversies, their influence cannot be denied, for they highlighted a broken system and forced it to confront its shortcomings. The big short guys not only made money, but they sparked a conversation about the need for reform and greater transparency in the financial world.

Other Iconic Investment Stories

Throughout history, there have been similar success stories in the world of investments. Examining these triumphs, we uncover common factors that contribute to their success. The enduring fascination with financial prodigies drives our curiosity in these iconic investment stories. And as we explore the topic further, we discover rising stars in the investment world, individuals with the potential to become the next big names in finance.

These personalities to watch capture our attention with their astute strategies and ability to spot profitable opportunities. Their achievements remind us that success in the investment realm is not limited to a few select individuals. Instead, it is a combination of skill, knowledge, and a keen eye for emerging trends.

These investment success stories are a testament to the potential for financial gains in a world filled with opportunities.

Frequently Asked Questions Of How Much Did The Big Short Guys Make

How Much Money Did The Guy From The Big Short Make?

The guy from The Big Short made a significant amount of money.

How Much Did Jamie And Charlie Make In The Big Short?

Jamie and Charlie’s earnings in The Big Short were not specified in the movie.

How Much Did Mark Baum Make In 2008 Crash?

Mark Baum earned a substantial amount during the 2008 crash, but the exact figures are not publicly available.

Did The Big Short Movie Make Money?

Yes, The Big Short movie made money and was a financial success.

How Much Money Did The Big Short Guys Make?

The Big Short guys made billions of dollars by correctly predicting and profiting from the 2008 financial crisis.

Conclusion

To sum it up, the Big Short guys made substantial profits by accurately predicting the collapse of the housing market and investing wisely. Their astute analysis and financial acumen led to lucrative returns, which catapulted them into the financial spotlight.

By recognizing the unsustainable nature of the housing bubble and capitalizing on the impending crisis, these individuals were able to transform their foresight into considerable financial gain. Importantly, this historical event underscored the importance of thorough research, critical thinking, and the ability to identify market opportunities.

However, it is worth noting that the film portrayed a simplified version of events, and not all investors were able to achieve such monumental success. Nevertheless, the story of the Big Short guys serves as a reminder that financial markets can be unpredictable, and those who are able to navigate these uncertainties stand to profit immensely.

I’m Robert Jesus & a dedicated writer with a unique focus: the lifestyle needs of larger individuals. I’m passionately write about the day-to-day necessities of big guys or fat guys, from clothing (shirts, shorts, t-shirts, etc) to longboards, skateboards, chairs, shoes, and hammocks. My work emphasizes the importance of inclusivity, shedding new light on a niche often overlooked in traditional lifestyle narratives. For big more updates stay with my social platforms like Pinterest, Twitter, Reddit, medium, and Quora